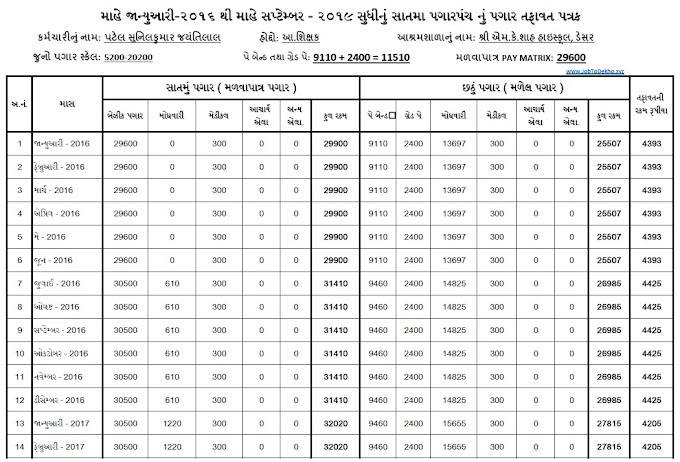

Good news for NPS employees win cases in Supreme Court on restoration of old pension

What is NPS?

Pension is a boon for old-age, especially for individuals retiring from Private sector jobs. NPS (National Pension System) helps individuals to plan their retirement by providing a low-risk appetite investment platform. It is a voluntary retirement saving scheme, which promotes systematic savings across working life, to meet a huge corpus amount at your retirement.

NPS is a platform regulated by PFRDA and promoted by the Government of India. This is an initiative to provide a pension opportunity to every Indian. In 2004 it was exclusive to Central Government employees and State Government employees. However, in 2009 it was made open for all.

NPS has always been a prioritized option by many when it comes to building a retirement corpus. The reason behind it isn’t just the Govt backing but many equally attractive pointers. A single investment can now be diversely capitalized into multiple platforms. Availability of a default, Active and Auto choice modes makes it easier for investors to branch out their capital in accordance with their needs. One can now invest in NPS>online and FundsIndia makes it even simpler by assisting you in every step.

Pension for all? Sounds like a lot of money.. How does NPS manage that? The contribution made under the NPS platform is pooled in a common Pension Fund. The pooled amount will be invested in Equities, Debts and Government securities by their approved fund managers, as per the guidelines laid down by PFRDA. Fund Managers ensure that the allocation is done with a diversified approach. The investment made will grow and the returns will be accumulated in the Pension fund to fuel the corpus fund of each individual.

0 Comments